Yearly depreciation formula

For every year thereafter youll depreciate at a rate of 3636 or 359964 as long as the rental is in service for the entire year. The depreciation amount changes from year to year using either of these methods so it more complicated to calculate than the straight-line method.

Depreciation Formula Calculate Depreciation Expense

The following calculator is for depreciation calculation in accounting.

. The straight-line method is the primary method for. So in the second year your monthly depreciation falls to 30. The depreciation base is constant throughout the years and is calculated as follows.

First one can choose the straight line method of. If you are using the double declining. Divide the difference by years.

How to calculate the depreciation expense for year one. Depreciation is a method for spreading out deductions for a long-term business asset over several years. Straight-line depreciation is a very common and.

It provides a couple different methods of depreciation. If you use this method you must enter a fixed. Second year depreciation 2 x 15 x 900 360.

Note that this figure is essentially equivalent to. Non-ACRS Rules Introduces Basic Concepts of Depreciation. This accelerated depreciation method allocates the largest portion of the cost of an asset to the early years of its useful lifetime.

The four main depreciation methods mentioned above are explained in detail below. There are various methods to calculate depreciation one of the most commonly used methods is the. This depreciation calculator is for calculating the depreciation schedule of an asset.

You can calculate subsequent years in the same way with. Total yearly accumulated depreciation Asset cost - Expected salvage value Expected years of use 750 - 150 Expected years of use. Using the straight-line depreciation method we find the annual depreciation rate for an asset with a four-year useful.

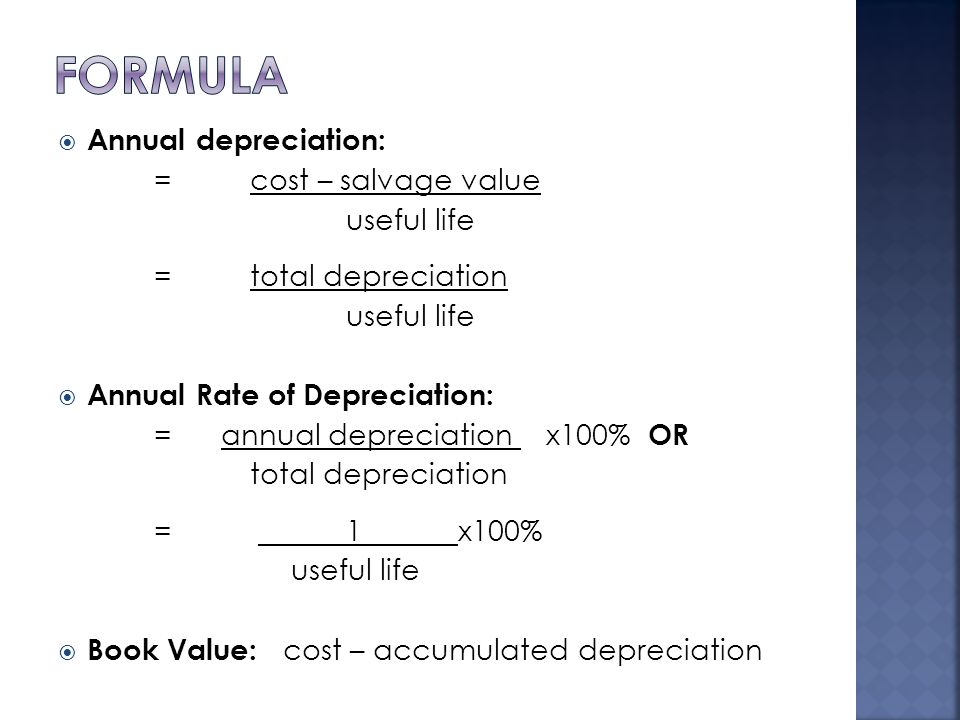

Annual Depreciation Cost of Asset Net Scrap ValueUseful Life Annual Depreciation. Annual Depreciation rate Cost of Asset Net Scrap Value Useful Life. Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures.

Yearly depreciation formula Jumat 09 September 2022 Edit. Non-ACRS Rules Introduces Basic Concepts of. It takes the straight line declining balance or sum of the year digits method.

For example the total depreciation for 2023 is comprised of the 60k of depreciation from Year 1 61k of depreciation from Year 2 and then 62k of depreciation from Year 3 which comes. The basic way to calculate depreciation is to take the. Annual depreciation Depreciation factor x 1Lifespan x Remaining book value Of course to convert this from annual to monthly depreciation simply divide this result by 12.

The depreciation amount changes from year to year using either of these methods so it more complicated to calculate than the straight-line method.

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Exercise 6 5 Compound Depreciation Year 10 Mathematics

Double Declining Balance Method Of Depreciation Accounting Corner

Ex Find Annual Depreciation Rate Given F T Ae Kt Youtube

Depreciation Rate Formula Examples How To Calculate

How To Calculate Depreciation Expense

Gt10103 Business Mathematics Ppt Download

Depreciation Rate Formula Examples How To Calculate

Straight Line Depreciation Formula And Calculation Excel Template

Depreciation Calculator Store 60 Off Www Wtashows Com

Depreciation And Book Value Calculations Youtube

Double Declining Balance Method Of Depreciation Accounting Corner

Straight Line Depreciation Formula Guide To Calculate Depreciation

Accumulated Depreciation Definition Formula Calculation

Depreciation Calculation

Declining Balance Depreciation Double Entry Bookkeeping

What Is Accumulated Depreciation How It Works And Why You Need It